How to Monetize Your Knowledge With a Consulting Business (Pt 2)

By Steven Imke | SBDC Consultant

“The goal of the pitch is not getting a commitment to hire you, but to make the engagement more personal…”

Previously, we discussed how to properly target, prospect, and qualify consulting engagement leads as a way to monetize your knowledge as a consulting business. In this post, we cover the pitch meeting and how to write a winning proposal.

Pitch Meeting

Once you have a qualified lead with a problem that your consulting business can solve, it is time to pitch them.

At this point, hopefully, the prospect has some basic idea of who you are, having responded in some way to your prospecting, and you have a basic understanding of the prospect based on your qualifying the lead. The goal of the pitch is not getting a commitment to hire you, but to make the engagement more personal and to clarify the points that need to go into your written proposal.

Rather than use your first meeting to just share why the prospect should hire your consulting business, consultants would be better served to use the pitch meeting to ask questions to get the prospect engaged in the process, and to show them that you understand and care about them.

“Nobody cares how much you know until they know how much you care.”

Theodore Roosevelt

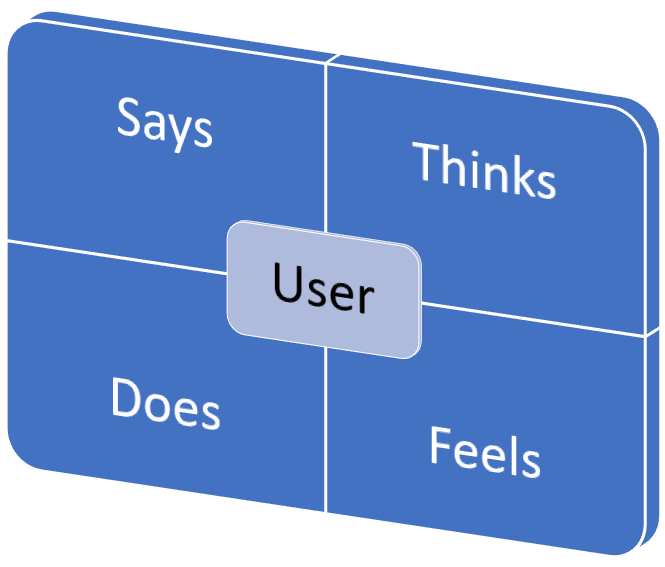

Based upon what you learned when you developed your empathy map about your ideal customer and what information you gathered on the specific prospect you gathered in the qualifying stage, you should design a series of questions to probe a little deeper to discover the pain and gain points that you can use in your proposal that will resonate with them. During your pitch, you want to demonstrate that you understand what is important to them, and show them that you care about them and their success.

Remember, if your customer works for a larger corporation, their decision to hire your consulting business is likely guided by how it will reflect on them personally. I always made it very clear to my clients that it was my job to make them look good to their boss. I told my customers that I expected them to personally take all the credit for any successes.

On the flip side, it is often better for the prospect to make no decision than to make a bad decision, so you will want to show them how you can take a majority the risk out of making a bad decision in your pitch, such as offering a money-back guarantee to assuage any fear they may have with making a bad decision.

Before you conclude your pitch, be sure to include a question or two so you can see what success looks like for the prospect. For example, you might ask:

- What is your desired outcome for this engagement?

- Can you give me an example of a project you were really happy with and why?

- How does this effort complement your overall business goals?

- If we followed up one year from now, what would need to happen for you to be happy with this engagement?

- What would you need to experience for you to refer me to a good friend or colleague?

During the pitch meeting, be sure to take notes as the prospect responds to your questions to show them that you are actively listening. It is also good advice to periodically check your understanding by paraphrasing or repeating what they said.

Remember that this first meeting with your qualified lead should be less about giving them a laundry list of what you can do, and be more about verifying all the information you have collected with your profile scrape, and collecting new information so you can customize your proposal/response based upon their specific needs.

According to Tim Rice, a Digital Marketer for Entrepreneur, too many consultants vomit up their pitch when they get in front of a qualified prospect for the first time. Having a prepared presentation for the pitch meeting and launching into it without getting the prospect engaged in the process or learning more about their goals says “Your needs are not special and I’m only pretending to care about you… Here is my boilerplate pitch”.

Your goal is to get enough information that you can use to develop a proposal and to make sure that you have answered all any questions both expressed and unexpressed that the prospect will need to move forward. You also want to understand their budget and provide a ballpark price for your engagement to make sure you are on the same page.

In an ideal situation, you can take what you learned from the pitch and sit down after the meeting when the pressure is off to develop a customized proposal document. However, sometimes you only get one meeting with the prospect, such as when they are interviewing several consultants for a specific task and plan to make a decision after all the interviews are completed. In these situations, you have to fly by the seat of your pants, and deliver your proposal or response at the pitch meeting based on what you have gathered during the qualifying phase, and what you learned from your opening questions.

By the end of the pitch meeting, you should have asked and answered enough questions to have a pretty good idea if this engagement is a good fit for both your consulting business and the prospect. Assuming that you can deliver on the prospect’s requirements, be sure to close by asking for the engagement. It is better to be assumptive in the closing, such as saying “Would you like to move forward?” than to leave it hanging by saying something like “Get back to me if you have any questions”.

If the prospect indicates that they will move forward, tell them that you will draft a proposal. Be sure that you understand the prospect’s payment terms. If you assume that they will pay net 30 and they pay net 60, this could create a cash flow problem for you. Finally, ask if they have a preferred format for a proposal before you try to craft your own version that they may then ask you to redo.

Alan Weiss in his book Million Dollar Consulting Proposals provides a Consulting Engagement Checklist that outlines everything you should take away from your pitch meeting so that you have all the information you will need to prepare a proposal.

Consulting Business Proposal

By the time you send the client a proposal, you should understand all of the prospect’s requirements, as well as their payment terms. Moreover, you should have had some pricing discussions so there should be no surprises when they see your consulting company’s proposal. You do not want to waste a bunch of time writing a proposal to not win it.

In your proposal document, don’t over-promise what you will do just to win the engagement. The prospect will likely place a lot of emphasis on the words and commitments you place in your proposal. I have seen time and time again that a consultant will promise the moon in their proposal, then a month or two down the road, the customer begins to question if the consultant oversold themselves. Overselling to get the engagement always backfires and creates bad blood, which results in bad word of mouth within the community.

Be sure that you outline how you will communicate in your proposal document. I recently introduced a fee-based advisor to one of my clients, who submitted a fixed-price proposal that was accepted by the client. There was no mention of the way communication would be handled in his proposal. My client was assuming that the fee-based advisor would attend all her team meetings, creating quite a time suck for him that was not anticipated in the original proposal he submitted.

In your proposal’s narrative, focus on the outcomes that your engagement will deliver instead of the process. “My SEO audit of your site will help increase your rankings in Google” is better than “I will do an audit and provide you with a list of recommendations”. Customers care about outcomes, not your process.

If you have to do some work up front, don’t be shy and ask for a deposit.

Don’t deliver a 40-page proposal full of legalese. While your lawyer would prefer that your proposal cover every possible contingency in writing, such a lengthy proposal will tend to focus on all the things that can go wrong and be too intimidating for many prospects to sign. I have seen too many good freelance consultants lose out on a gig because their lawyer provided them a document full of legalese and escape clauses that made the prospect too nervous about the engagement to sign it. Instead, keep your proposal short. The best proposals are about three pages long. Alan Weiss, in his book Million Dollar Consulting Proposal, provides a Consulting Proposal Template that includes the following key topics:

- Situational Appraisal

- Objectives

- Metrics

- Value created

- Scope of work

- Timing

- Joint accountabilities

- Terms and conditions

- Acceptance and signatures (which you will have already signed)

Finally, you need to make it easy for the other party to accept your proposal. Consider uploading an electronic version of your proposal to your Dropbox or Google Drive and using an e-signature tool, like the free version of HelloSign, to allow your customers to e-sign your proposals. Be sure to already have your signature on the uploaded document, so all it needs is the prospect’s signature to go into effect.

Send the prospect an email that says the proposal is complete and awaiting their signature. If you use a Gmail account, it is also helpful is to employ an email tracking tool, like the free version of Mailtrack, or a similar product to know if and when your proposal was opened by your prospect.

This blog, and more, can be found on Steve’s consulting blog page, SteveBizBlog.com