saraeknudsen

3 Risk Levels to Becoming a Business Owner

By Steve Imke | Pikes Peak SBDC Consultant | Writer at www.stevebizblog.com

"Starting a business from scratch is by far the riskiest way to become a business owner."

Most of the clients I see want to start their business from scratch, but there are 2 other options to becoming a business owner. The first option is to buy an existing business and the second is to buy a franchise. Clients often tell me that these two options simply cost too much. They argue that they are choosing to start from scratch because it is the cheaper path.

At that point in the conversation, I often remind them that starting a business from scratch is by far the riskiest way to become a business owner. In fact, statistics from the US Department of Commerce say that 65% to 90% of start-up business are likely to fail within the first five years. In other words, only 10% to 35% will have a chance of success. The principle reason for this high failure rate is that most businesses take on too many fixed expenses early on. On top of that, their revenue ramps up slower than planned and the business simply runs out of money before breaking even and turning a profit.

One client who had previously been a pilot in the US Air Force summed it up when he said,

“I guess they had too much payload and not enough runway.”

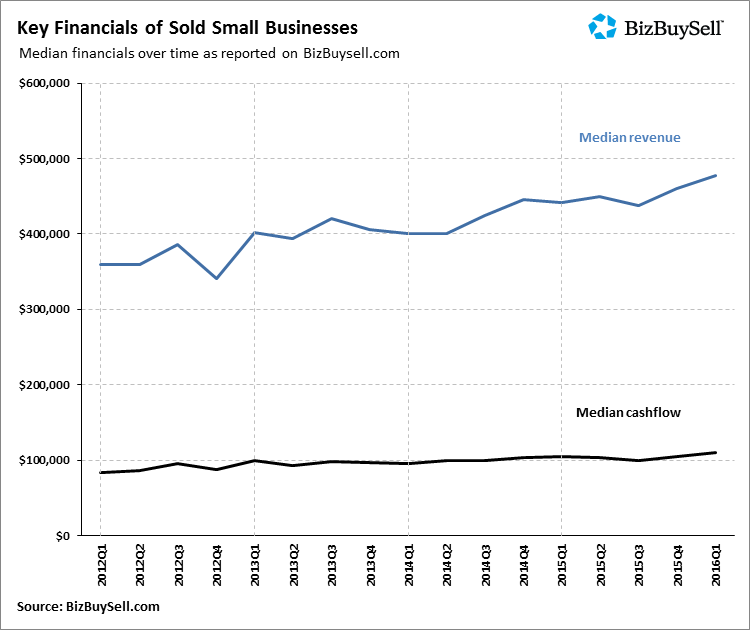

Entrepreneurs that buy an existing business have a 90% to 95% chance of still being in business after 5 years. The principle reason for this higher success rate is that when you buy an existing business, you already have revenue from customers and have a predictable level of expenses. You know these expenses are less than the amount of revenue, which leaves the business some profit and cash flow to work with. Moreover, existing businesses often have employees that already know their jobs, are well trained, and the business has proven processes to capture customer value.

Entrepreneurs that buy into a franchise concept have a 90% chance of still being in business after 5 years. Although franchises need new customers to generate revenue, the entrepreneur is often buying brand awareness and a proven system. Moreover, most new franchises are able to reduce the cost of goods sold by taking advantage of the economies of scale established by the franchiser since they have franchise-wide buying power.

When you buy a franchise or another person’s business, you also have access to someone who knows both the business and financial model as well as someone who has a vested interest in your success. Obviously this is not the case with start-ups. Let’s not forget that the primary goal of business ownership is to make money for the owner.

Existing businesses make money on day one. A successful franchise will earn the owner income not too long after starting up. However, a start-up, even one that survives, may take months or years to begin to pay the owner a salary for working in the business.

When it comes to business ownership, have you considered buying vs. starting from scratch?

For more articles like this, visit Steve's Blog here!

The Hidden Value of Crowdfunding

By Steve Imke, SBDC Consultant and Small Business Specialist

Traditionally, entrepreneurs had 2 options to raise funds to start their business. They could either get a loan or give away ownership to investors. Because of the risk involved in the early stages of a small business, founders had to give up large blocks of equity to entice an early stage equity investor. On the other hand, having to make interest and principle payments for debt financing can, at best, slow growth or even cripple a company during it’s fragile early stages. Enter crowd funding, a viable option to preserve equity and eliminate the need for debt.

In a real estate deal a few years ago, a builder I know needed to raise capital to build a new residential tower in downtown Denver. With a mock-up of the finished building, some computer generated images, and some floor plan layouts, he pre-sold many of the units at a discount to come up with the seed money he needed to get the project off the ground. Crowd funding shares many similarities to the strategy used by the builder to raise capital and validate the concept.

In many cases, a product based crowd sourcing campaign allows people to pre-order the product before anyone else. This campaign accomplishes several vital steps for a company still in its early stages.

1. It provides the company with the capital it needs to build the first wave of products without either giving away equity, or pay back principle, or pay the lender interest. These benefits occur when equity is most under valued and capital preservation is most needed.

2. It validates the hypothesis that consumers are willing to exchange cash for the product. Proving the value of the product is a major tenet of the business model canvas and for business that employ the lean start-up methodology.

3. It can raise to the surface demand for new and innovative products that might be hidden without a large number of investors actually seeing the product.

4. It attracts early adopters who become social activists, evangelizing the product to their networks and raising product awareness.

5. Tiered raises create excitement. Excitement can create a valuable feedback loop to further product improvement by exposing the product to early adopters, the people who are most likely to provide feedback.

6. It provides funding for a particular product and not the company. It is like a direct investment in a single oil well rather than buying the diversified portfolio of an oil company, such as Exxon.

In addition to pre-order campaigns, some crowd funding campaigns allow for micro ownership of an early stage company. This creates a whole new class of investors who can buy into companies before they become large and go public.

Before crowd funding, only accredited investors (investors with more than a million dollars in net-worth or investors that earn over two hundred thousand per year in wages) could get involved with ground floor investments. Prior to crowd funding, companies who tried to raise money from unaccredited investors would run afoul with the Securities and Exchange Commission (SEC). Crowd sourcing allows small investment levels that bypasses SEC oversight, opening the opportunity for micro investors wanting to buy into early stage companies.

These micro investors hope these businesses will grow substantially. They hope that these businesses will then give them a significant return on their investment when the company experiences a exit event such as being acquired or going public. Before crowd funding, even accredited investors would have to either invest large sums of money in only a few companies, which is very risky since there is limited diversity in invested capital, or find a venture capital fund to invest in and lose ultimate control over the specific investment allocations in new companies. With crowd funding, a small time investor with only a few thousands dollars can invest in dozens of hand picked companies and achieve investment diversification, a domain only previously available to venture capital principle investors.

Setting up a crowd funding campaign generally requires a good video demonstration of a sexy new product. Need a little help getting your idea from conception to a point where you are ready to begin a crowd sourcing campaign? No problem! Companies, such as Quirky can help get you there in exchange for micro equity stakes.

However, the funding of your venture may be the easy part. The real work comes when the new company or product gets funded. Now the owners must produce the product. To do that, they must now manage a long supply chain and learn to run a real business.

For more articles like this, visit Steve's Blog here!

Turn Your Financials into a Powerful Management Tool

As business owners we serve in so many capacities, it is difficult, if not impossible to do everything well. When we get pressured, we get stressed. Negative stress (yes, there is positive stress) can cause exhaustion and illness often follows. Most of us have experienced that sinking feeling when we realize we are “in over our heads.”

When it comes to our financials we try really hard to get everything not only in the system, but in the right bucket. Time is often our enemy. Invoicing gets behind which can cause a cash flow crisis. The ‘taxman cometh’ and we might not be ready.

Whether we do our own books or have them done, we are ultimately responsible for the result. Although responsibly managing the ‘books’ was probably not the reason we started our business, it will be one of the primary reasons we succeed in business.

It all starts with organization. Chaos has no place in a financial system. It starts with a Chart of Accounts that actually matches the business and more importantly you, the owner. The second step is imputing good information and most importantly getting the data in the right place. Once these steps have been taken, you can then produce various reports on a regular basis. Those up-to-date reports can provide the information needed to find the answers to the following questions and more:

- Are my products/services priced to make a profit?

- What is labor actually costing me?

- What are my true production costs?

- Are my overhead costs under control?

Has your business been affected by the recent floods?

Across Colorado several businesses have been affected by the recent floods. The Colorado SBDC Network is here to help your business with the recent disasters including wildfires and floods. If you have questions, concerns, or need guidance please contact your local SBDC for assistance through the disaster loan applications, long term planning, insurance navigation, physical and economic loss estimations, business preparedness and more.

The NEECCO SBDC and several others across the state are partnering with the SBA Disaster Assistance to host Business Recovery Centers.

Greeley will have the Recovery Center at the Greeley Chamber of Commerce on September 26th (9:00 am- 6:00 pm) , 27th(9:00 am- 6:00 pm) , and 28th(9:00 am- 1:00 pm) .